Banks Announce New Cash Withdrawal Limit For Customers As PoS Operators Adjust Charges

- Nigerian banks have made adjustments to their over-the-counter cash withdrawal limits for all customers

- The development is part of its efforts to ensure customers have enough cash for their daily transactions

- The move comes after point-of-sale operators decided to adjust charges due to the government's EML levy

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

Nigerian financial institutions have announced an adjustment to the maximum over-the-counter withdrawal limit.

This has been increased to N50,000 per day from the previous limit of N5,000, which was in effect until November.

Read also:Big Loss Hits Dangote As His Sugar Company Declines In Profit

According to Punch, this development was observed in several bank branches in Abuja.

The report said banks, including Guaranty Trust Bank (GTBank) and Zenith Bank, have made the adjustments.

At the GTBank branch along Airport Road, customers could now withdraw up to N50,000 over the counter.

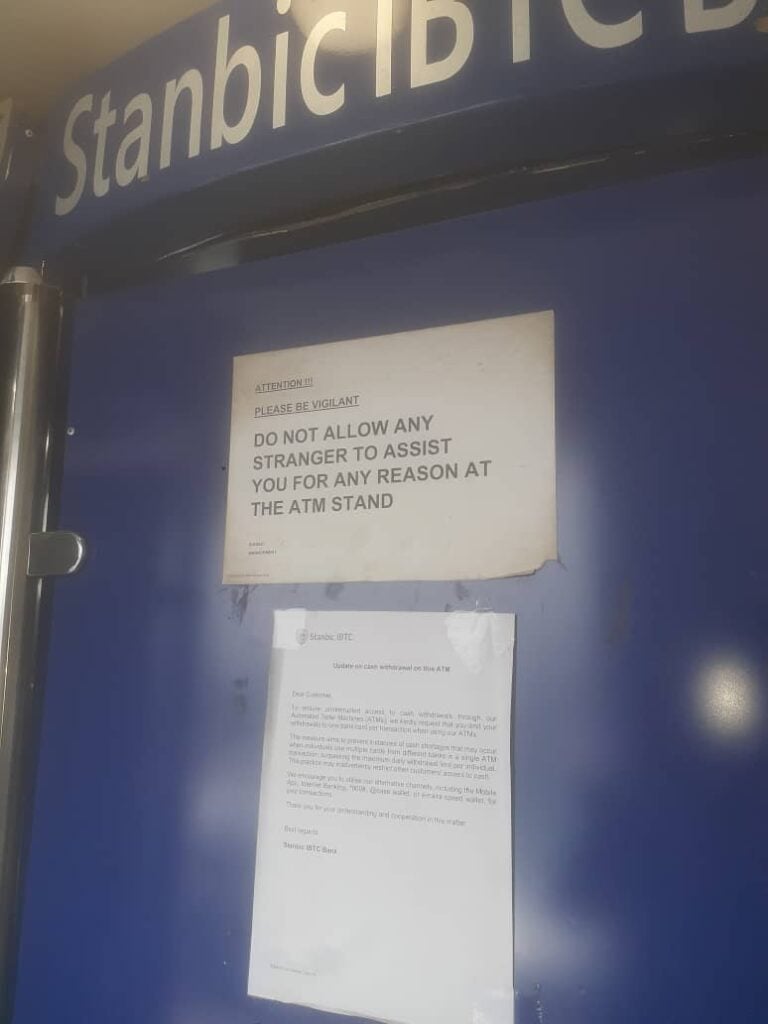

However, the withdrawal limit at the bank’s Automated Teller Machines (ATMs) remained N20,000.

A bank official, who requested anonymity, attributed the adjustment to an increased supply of cash, stating:

“We now have more cash, and that is why we are giving out more money. Simple."

A bank teller, Kemi Adekunle, also confirmed the development to Legit.ng.

Read also:Right To Life In Jeopardy In Nigeria Amid Femicide Epidemic

"Yes, we have more cash for our customers."

The decision to increase withdrawal limits is expected to help ease customer cash flow challenges.

Legit.ng earlier reported that the CBN instructed banks to ensure sufficient cash is available for customers at the counter and ATMs, warning that violations would result in penalties.

The CBN also released contact details for Nigerians to report erring banks across different states for possible sanction.

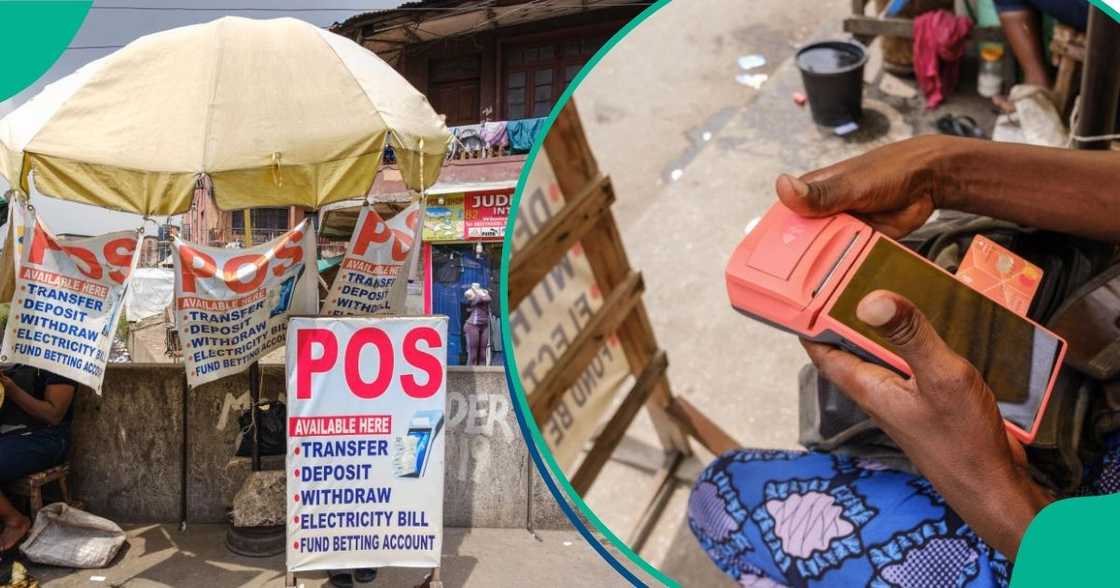

PoS operators announce new charges

Legit.ng also reported that POS operators have adjusted their withdrawal and deposit charges in response to the federal government's new electronic levy charges.

The FG's new EML placed a charge of N50 for every N10,000 and above on recipient accounts, with PoS operators saying that this had resulted in higher charges.

Proofreading by Nkem Ikeke, journalist and copy editor at Legit.ng.